Solar Investment Tax Credit (ITC) | SEIA

By this point, we all know that going solar is advantageous for the environment & saving money on your electricity costs. But did you also know that switching to solar power may significantly lower the amount of federal income taxes you owe to the IRS? With the help of the 30% Solar Investment Tax Credit, you can save more than ever right now!!

If you live in the Southwest, you have undoubtedly seen several solar installations on both residential and business properties. Solar is advantageous for many individuals, but you may wonder, “I know solar has advantages for the environment, but can I afford it and would it save me money?” Even though the cost of solar has decreased over time, additional substantial financial help is still available in the form of regional, state, and federal tax benefits. Installing solar is a terrific way for tax paying homeowners to save money!

Solar Tax Credits in Arizona

If you’re from Arizona, you’re aware of how much sun we get here. We should have some of the strongest solar incentives in the US, after all!

The Residential Arizona Solar Tax Credit, which was established in 1995, reimburses you 25 percent of the cost of your solar panels, up to $1,000, right off of your personal income tax. The solar panel tax credit may be used for your Arizona personal income tax in the year that you go solar or it can be held over for the next five years.

You have to own your solar array in order to qualify for the state solar tax credit. Residents who sign a lease or PPA are not eligible since the leasing firm owns their system, yet another reason why leasing solar is a bad idea! With Watt Masters solar financing options, you can get started with little to no money down and qualify for all of the tax incentives available.

Federal Solar Tax Credits

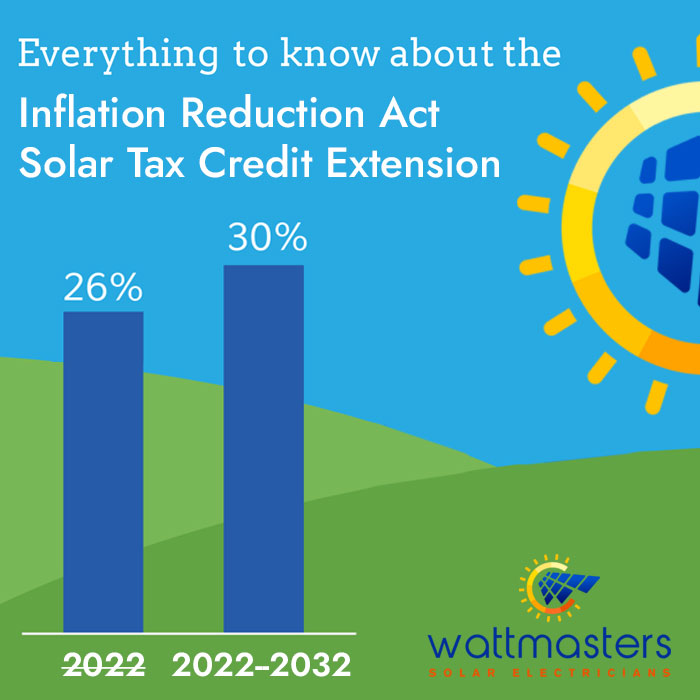

The best solar savings option for American taxpayers is the Federal Solar Tax Credit, generally known as the Solar Investment Tax Credit (ITC). The ITC’s 26% rate was due to expire in 2024, and was only applicable to solar installations finished by the end of 2022. Solar is predicted to have a career-high years 2022 and 2023 since the solar tax credit was no longer planned to be available after that.

However, with the recent passing of the Inflation Reduction Act, the federal tax credit for solar panels is now 30% until 2032! That said, being it is a largely democratic-backed bill, it is likely that it could be reversed should the opposing party take office – especially considering the controversy surrounding other parts of the bill. So don’t wait to take advantage of the federal solar tax credit, get started now while you still can save the most amount of money ever in history!

What is the process for the Federal Solar Tax Credit?

Solar is already a significant investment, but solar tax credits make it much more compelling when you take into account the money you will save with the IRS. The dollar-for-dollar solar panel tax credit, which is applied to your federal income taxes if you own your solar array, may lower or even completely erase the amount of tax debt you have with the IRS.

There is no upper limit on the amount you may claim for the solar tax credit, which is applicable to both residential and business commercial solar installation in Phoenix and around the country. It is crucial to understand that the solar tax credit is a dollar-for-dollar solar tax credit that you may use for your federal income tax and is NOT a solar panel refund.

For as much as the IRS solar tax credit is still in existence, you may “roll over” any leftover credits into future years even if you don’t have the tax obligation to use the whole solar tax credit in one year. This implies that although you may still enjoy the full benefits of the 2020 Solar Tax Credit, you can still take advantage of all of the reasons to go solar this year (increasing utility prices, NEM rates).

But keep in mind that if you get into a PPA or lease with a solar panel installation, you are not the system’s owner. As a result, you are ineligible for the solar investment tax credit. For this reason, buying your solar panel system while paying taxes makes considerably more sense. You will increase the value of your property in addition to being eligible for the solar tax credit. And, you can often finance your system at a similar or lower cost.

Beyond 2020, the Federal Solar Tax Credit

The solar tax credit was first introduced in 2005 with the goal of promoting individual and business investment in renewable energy and lowering the price of this crucial technology. The average Price Per Watt (PPW) for a solar installation has decreased by almost 60% after a decade of widespread success during which the solar panel rebate was repeatedly extended!

In reality, solar energy is currently cost-competitive with building new fossil fuel-powered power plants. It is obvious that the Solar Investment Tax Credit has been successful with a price decrease of this size. While it is anticipated that solar will continue to expand, the Federal Solar Tax Credit can be changed or revoked at anytime.. In other words, now is the greatest time to get solar, while there are still solar incentives available from the government.

More Topics: Is Residential Solar Installation in Phoenix a Good Investment?

How can I apply for the tax credit for solar investment?

When you have made an investment in a solar system, you must demonstrate it to the government in order to be eligible for a federal solar tax credit. In order to do so and get the federal solar tax credit in 2022, you need IRS Form 5695.

Use the procedures listed below to claim your solar tax credit if you do your own taxes:

- All of your installation-related receipts should be stored safely.

- Verify your eligibility for the IRS tax credit for solar energy. (If you didn’t lease the system, you probably qualify.) If you’re unsure, see a tax expert.)

- To calculate your renewable energy credits, complete IRS Form 5695.

- Your 1040 individual tax return should include information about your renewable energy credit.

We hope that this is an effective introduction to the Federal Solar Tax Credit and that it will be useful to you as you do your own research in determining if solar panel installation is right for you.

There really are a lot of moving parts though, and it can quickly get overwhelming. The easiest way to go solar is by calling a reputable solar installer, like Watt Masters, who can answer all of your questions, address all of your concerns, and help you analyze your property, electricity usage, and navigate applying for tax credits, permits and more – we help make going solar easy.

Get in contact with us for a free solar consultation. We would be happy to help!

Contents

- 1 Solar Investment Tax Credit (ITC) | SEIA

- 2 Solar Tax Credits in Arizona

- 3 Federal Solar Tax Credits

- 4 What is the process for the Federal Solar Tax Credit?

- 5 Beyond 2020, the Federal Solar Tax Credit

- 6 How can I apply for the tax credit for solar investment?

- 7 Say goodbye to expensive electric bills with $0 down solar from Watt Masters